Intel has reported full-year revenues of US$43.6 billion, operating income of US$15.9 billion, net income of US$11.7 billion, and an EPS of US$2.05, all company records. The company generated approximately US$16.7 billion in cash from operations, paid cash dividends of US$3.5 billion, and used US$1.5 billion to repurchase 70 million shares of common stock.

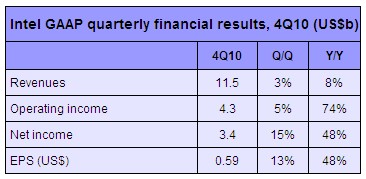

For the fourth quarter of 2010, Intel posted revenues of US$11.5 billion. The company reported fourth-quarter operating income of US$4.3 billion, net income of US$3.4 billion, and EPS of US$0.59. Fourth-quarter revenues, operating income, net income, and EPS were also all records.

For the first quarter of 2011, Intel expects its revenues to reach US$11.5 billion plus or minus US$400 million, with gross margin to hit 64% plus or minus a couple of percentage points. Meanwhile, the company's R&D plus MG&A spending will reach approximately US$3.4 billion with impact of equity investments and interest and others to gain approximately US$200 million. The depreciation will be approximately at US$1.2 billion.

As for 2011, Intel forecasts its gross margin at 65%, plus or minus a few percentage points and spending (R&D plus MG&A) will hit US$13.9 billion, plus or minus US$200 million with R&D spending alone to be approximately US$7.3 billion.

Intel also expects its tax rate to be approximately 29% with depreciation to be approximately US$5 billion, plus or minus $100 million and capital spending to be $9.0 billion, plus or minus $300 million.

|