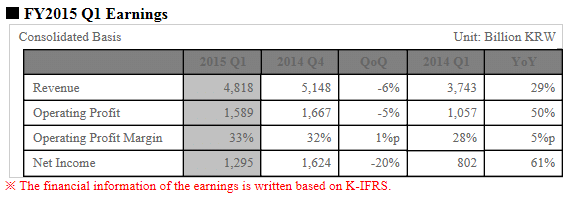

SK Hynix Inc. today announced financial results for its first quarter 2015 ended March 31, 2015.

The consolidated first quarter revenue was 4.8 trillion won dropped 6% from 5.1 trillion won of the previous quarter due to declined shipment and product prices according to seasonal weak demand. Nevertheless, year-on-year the revenue rose 29% as well as operating profit totaled 1.59 trillion won increased 50%.

Operating margin for the quarter was 33% improved from 32% of the previous quarter and 28% of the last year thanks to elevated cost efficiency through enhanced products portfolio and yield rate. Net income amounted to 1.3 trillion won with net margin of 27% reflecting income tax expenses.

Quarter-over-quarter, DRAM bit shipment and the average selling price decreased 5% and 4% respectively. The shipment was affected by weak demand from PC and consumer DRAM although the demand from server DRAM counterbalanced partially. The average selling price of mobile and server DRAM relatively remained stable compared to weak PC DRAM price.

For NAND Flash, the bit shipment remained stable but the average selling price dropped 7%. The shipment stabilized owing to continuous effect of brand new mobile gadgets.

SK Hynix will strengthen its cost competitiveness by expanding the proportion of 2Ynm DRAM sharply and finishing preparing for successful mass production of 2Znm DRAM in the second quarter. Plus, the Company will increase the portion of DDR4 products in server and mobile DRAM markets to catch up with the market transition.

For NAND Flash, SK Hynix is to launch 1Xnm TLC during this ongoing quarter and gradually increase the manufacturing ratio of it. Moreover, the Company will complete verification processes of 3D NAND products with clients through pilot-scale production within this year.

|