Seoul – October 27, 2011 – Hynix Semiconductor Inc. (‘Hynix’ or ‘the Company’, www.hynix.com), the world's second largest memory chips maker, today announced financial results for its third quarter 2011 ended September 30, 2011.

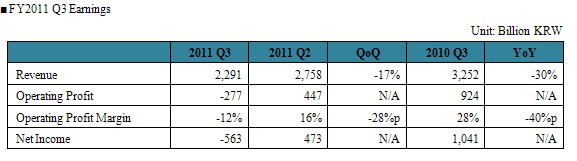

The Company posted the consolidated third quarter revenue of 2.29 trillion won, a 17% decline from 2.76 trillion won of the previous quarter due to weakness in IT demand from uncertainty of the global macroeconomic recovery. Operating loss was 277 billion won with operating margin of negative 12% reflecting inventory write down of 132 billion won due to the steep DRAM average selling price drop. Net loss for the quarter was 563 billion won. It was negatively impacted by net foreign currency related loss of 250 billion won.

During the quarter, DRAM bit shipment increased 9% sequentially while the average selling price declined 29%. For NAND Flash, the bit shipment increased 16% while the average selling price declined 14% sequentially.

Overall, the demand is weak due to the growing uncertainty of the global economy derived from the financial crisis in Europe in the third quarter. Specifically, the average selling price of DRAM dropped significantly due to slow demand from PCs. In terms of the demand growth, the NAND Flash market was more favorable.

In DRAM business, the company will increase the portion of 30nm class process products to around 40% by the end of this year from over 20% at the end of the third quarter. Hynix aims to complete the development of 20nm class process in the fourth quarter. The sales portion of non-PC DRAMs was 70% in the third quarter and the Company plans to maintain the current level through year-end. For the NAND Flash business, the 2Xnm class process portion was over 70% at the end of the third quarter and we plan to expand this portion to high 70% by the end of this year. The development of the next generation 2Ynm class process will be completed in the fourth quarter of this year.

|