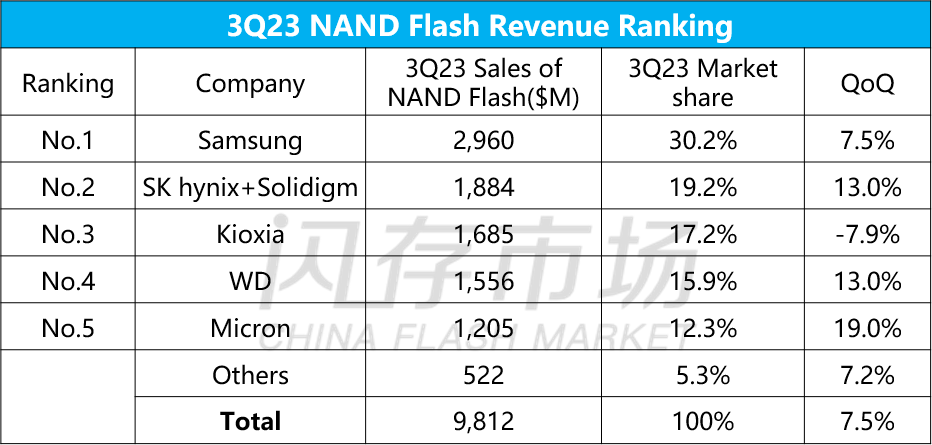

The size of the global memory market has successfully achieved a quarter-on-quarter rebound in the second and third quarters, and will continue to the fourth quarter. However, due to the fact that the current demand performance is not as good as in previous years, and the price increase is too fast and too high, it has also suppressed some demand for stocking. These will affect the growth of the overall market size in the fourth quarter to a certain extent. According to CFM data, the global NAND Flash market revenue in 3Q23 increased QoQ by7.5% to US$9.81 billion, and the DRAM market increased QoQ by 22.4% to US$13.06 billion; the overall memory market revenue in 3Q23 was US$22.98 billion, increased 16% QoQ but decrease 28% YoY. NAND Flash

The overall average price of NAND Flash increased sequentially in the third quarter. Except for Kioxia, which suffered a sequential decline in NAND sales revenue due to the decline in NAND Flash shipments from July to September, other NAND manufacturers all achieved sequential growth in NAND Flash revenue in the third quarter.

· Samsung's NAND Flash revenue in 3Q23 reached US$2.96 billion, a increase of 7.5% from the previous quarter, and its market share was 30.2%. · Kioxia’s NAND Flash revenue in 3Q23 was US$1.68 billion, a decrease of 7.9% from the previous quarter, and its market share was 17.2%. · SK hynix (including Solidigm) had NAND Flash revenue of US$1.88 billion in 3Q23, a increase of 13% from the previous quarter, and its market share was 19.2%. · Western Digital's NAND Flash business revenue in 3Q23 was US$1.56 billion, up 13% from the previous quarter, and its market share was 15.9%. · Micron’s NAND Flash revenue in 3Q23 was US$1.205 billion, up 19% from the previous quarter, and its market share was 12.3%.

Source:CFM Note:Branded revenue, millions of dollars DRAM

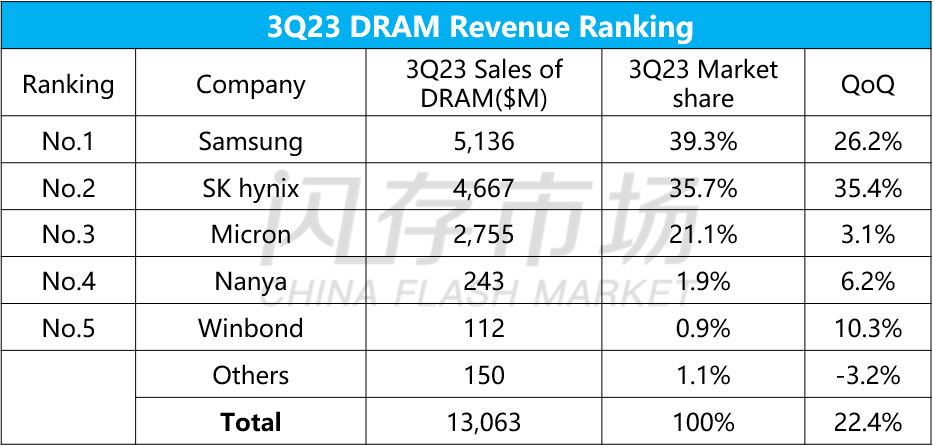

Driven by the quarter-on-quarter increase in DRAM shipments and average prices, Samsung and SK hynix both experienced revenue growth of 20%+ and 30%+ in the third quarter. Among them, SK hynix successfully turned its DRAM business from losses to profits.

· Samsung's DRAM sales revenue in 3Q23 reached US$5.136 billion, a increase of 26.2% from the previous quarter, and its market share was 39.3%. · SK hynix's DRAM revenue in 3Q23 reached US$4.667 billion, a increase of 35.4% from the previous quarter, and its market share was 35.7%. · Micron’s DRAM revenue in the fourth quarter was US$2.755 billion, up 3.1% from the previous quarter, and its market share was 21.1%. · Nanya’s DRAM revenue in 3Q23 increased by 6.2% quarter-on-quarter to US$243 million. · Winbond’ second-quarter DRAM revenue increased by 10.3% quarter-on-quarter to US$112 million.

Source:CFM Note:Branded revenue, millions of dollars

|