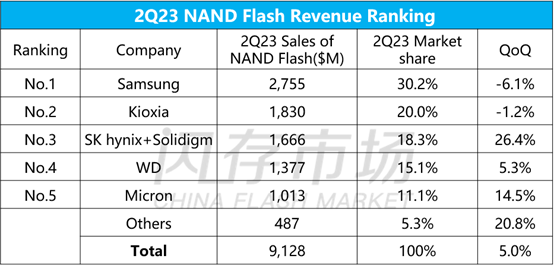

Different from the weakness in the first quarter, it can be seen that the memory market has picked up significantly in the second quarter, breaking the continuous decline since the second quarter of 2022, and returning to growth. According to CFM data, the global NAND Flash market revenue in 2Q23 increased QoQ by 5% to US$9.13 billion, and the DRAM market increased QoQ by 11.9% to US$10.675 billion; the overall memory market revenue in 2Q23 was US$19.803 billion, increased 9% QoQ but decrease 54% YoY. NAND Flash Excluding the exchange rate factor, only Samsung's NAND Flash sales revenue declined in the second quarter, and the others achieved a quarter-on-quarter increase in NAND Flash revenue in the second quarter. Although Flash ASP still fell in the second quarter, all NAND manufacturers achieved a quarter-on-quarter increase in NAND Flash bit shipments in the second quarter, which also drove the global NAND Flash market to grow by 5.0% quarter-on-quarter in the second quarter. l Samsung's NAND Flash revenue in 2Q23 reached US$2.755 billion, a decrease of 6.1% from the previous quarter, and its market share was 30.2%. l Kioxia’s NAND Flash revenue in 2Q23 was US$1.83 billion, a decrease of 1.2% from the previous quarter(up 2% QoQ in JPY), and its market share was 20.0%. l SK hynix (including Solidigm) had NAND Flash revenue of US$1.666 billion in 2Q23, a increase of 26.4% from the previous quarter, and its market share was 18.3%. l Western Digital's NAND Flash business revenue in 2Q23 was US$1.377 billion, up 5.3% from the previous quarter, and its market share was 15.1%. l Micron’s NAND Flash revenue in 2Q23 was US$1.013 billion, up 14.5% from the previous quarter, and its market share was 11.1%.

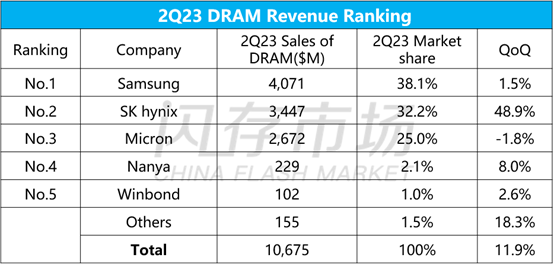

Source:CFM. Note:Branded revenue, millions of dollars DRAM In 2Q23, Samsung’s DRAM Bit shipments increased by 10% month-on-month, SK hynix’s DRAM Bit shipments increased by 35% month-on-month, and it is also the only DRAM ASP that achieved a high single-digit percentage month-on-month growth. Micron’s DRAM Bit shipments increased by 10% month-on-month. The quarter-on-quarter increase in overall bit shipments made up for the decline in prices, driving the DRAM market to grow by 11.9% quarter-on-quarter to US$10.675 billion in the second quarter. l Samsung's DRAM sales revenue in 2Q23 reached US$4.071 billion, a increase of 1.5% from the previous quarter, and its market share was 38.1%. l SK hynix's DRAM revenue in 2Q23 reached US$3.447 billion, a increase of 48.9% from the previous quarter, and its market share was 32.2%. l Micron’s DRAM revenue in the fourth quarter was US$2.672 billion, down 1.8% from the previous quarter, and its market share was 25.0%. l Nanya’s DRAM revenue in 2Q23 increased by 8% quarter-on-quarter to US$229 million. l Winbond’ second-quarter DRAM revenue increased by 2.6% quarter-on-quarter to US$102 million.

Source:CFM. Note:Branded revenue, millions of dollars From the perspective of profit level, the five big memory manufacturers of Samsung, SK hynix, Micron, Kioxia and Western Digital have lost more than 18.5 billion US dollars in the first half of 2023. Faced with huge operating pressure, they have continued to make efforts of production and inventory reduction, but also raised the quotations of some advanced process products. Although it will take time for the actual demand to pick up on a large scale, the demand side has also recognized the fact that the price is now at the bottom and has accepted the price increase for some new demand. Although there was no substantial improvement in the demand side in the third quarter, the supply has been greatly tightened due to the active reduction of production by major manufacturers. Before the demand recovers obviously, it is difficult for the overall price to reverse in a "V" or "U" shape. The game between supply and demand will continue, and the memory market will show an "L"-shaped development, according to CFM. However, due to different market supply strategies, the pricing trends of various manufacturers are not synchronized. At the same time, the consumption of inventory also takes time, which leads to certain variables in the market trend.

|