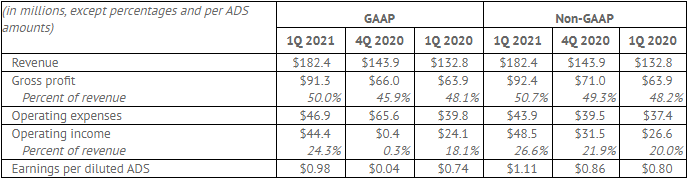

Silicon Motion Technology Corporation (NasdaqGS: SIMO) (“Silicon Motion” or the “Company”) announced its financial results for the quarter ended March 31, 2021. For the first quarter, net sales (GAAP) increased sequentially to $182.4 million from $143.9 million in fourth quarter 2020. Net income (GAAP) increased to $34.4 million or $0.98 per diluted ADS (GAAP) from net income (GAAP) of $1.4 million or $0.04 per diluted ADS (GAAP) in fourth quarter 2020. For the first quarter, net income (non-GAAP) increased to $38.7 million or $1.11 per diluted ADS (non-GAAP) from a net income (non-GAAP) of $29.9 million or $0.86 per diluted ADS (non-GAAP) in fourth quarter 2020. First Quarter 2021 Review “As we had previously communicated, we are seeing very strong demand for our SSD and eMMC+UFS controllers,” said Wallace Kou, President and CEO of Silicon Motion. “Customer demand was well in excess of our ability to supply as both our foundry supply and inventory on hand are limited.” Key Financial Results

Other Financial Information

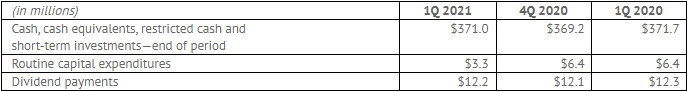

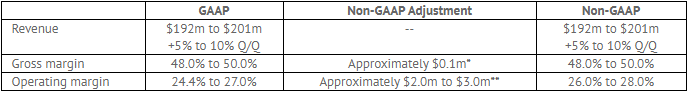

During the first quarter, we had $3.3 million of capital expenditures for the routine purchase of software, design tools and other items. Returning Value to Shareholders On October 26, 2020, our Board of Directors declared a $1.40 per ADS annual dividend to be paid in quarterly installments of $0.35 per ADS. On February 26, 2021, we paid $12.2 million to shareholders as the second installment of our annual dividend. On November 21, 2018, we announced that our Board of Directors had authorized a new program for the Company to repurchase up to $200 million of our ADS over a 24-month period. On October 26, 2020, the Board of Directors of the Company authorized the extension of the expiration of this program to November 21, 2021. Since the start of this program, we have repurchased $84.8 million of our ADSs and $115.2 million remains available for repurchase under the program. There were no share repurchases in the first quarter. Business Outlook “With strong support from our business partners, we have secured more foundry supply and are now able to deliver a larger portion of the SSD and eMMC+UFS controllers previously ordered by our customers,” said Wallace Kou, President and CEO of Silicon Motion. “While we now expect to deliver much stronger full-year sales, our ability to fulfill customer demand remains capped by very tight foundry supply availability.” For the second quarter of 2021, management expects:

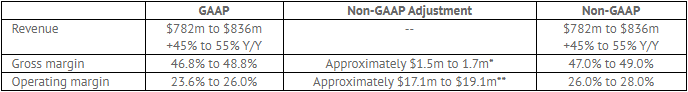

* Projected gross margin (non-GAAP) excludes $0.1 million of stock-based compensation ** Projected operating margin (non-GAAP) excludes $2.0 million to $3.0 million of stock-based compensation. For the full year 2021, management expects:

* Projected gross margin (non-GAAP) excludes $0.4 million to $0.6 million of stock-based compensation and SSD solutions restructuring $1.1 million. ** Projected operating margin (non-GAAP) excludes $16.0 million to $18.0 million of stock-based compensation and SSD solutions restructuring $1.1 million.

|