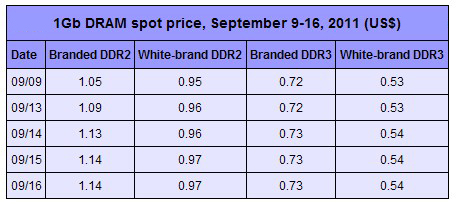

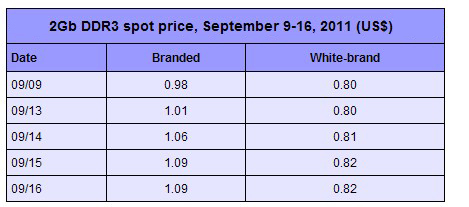

Overall pricing for DRAM at the spot market this week (Sep 13-16) reported a strong price rise stimulated by announced plans by Taiwan-based players to cut production.

Since market sources suggested that Korea-based players might follow suit in the short term, and in case there are any supply issues going forward, local traders saw this as a trigger for price increases. Korea-based suppliers have not yet announced any production plans so far, the research firm added.

As of the noon session of September 16, spot pricing of a branded 2Gb chip jumped 8% to US$1.09 and DDR3 white-branded 2Gb DDR3 was up 2% to US$0.82.

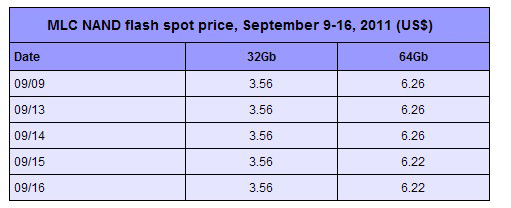

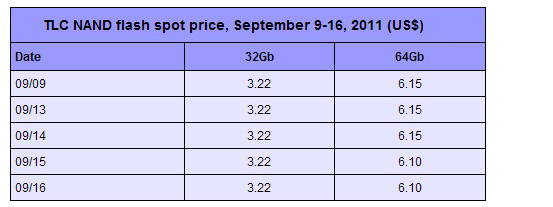

Price trends for NAND flash remained flat at the spot market this week on low demand. Though the peak season is around the corner, orders for memory cards and USB drives remained weak in the channel, the research firm cited local traders as saying.

As of September 13, spot price for 32Gb MLC was flat at US$3.56 while 64Gb MLC dropped 1% to US$6.22.

Orders from OEM players in the fourth quarter for the NAND flash contract market are healthy at the moment, added the research firm.

|