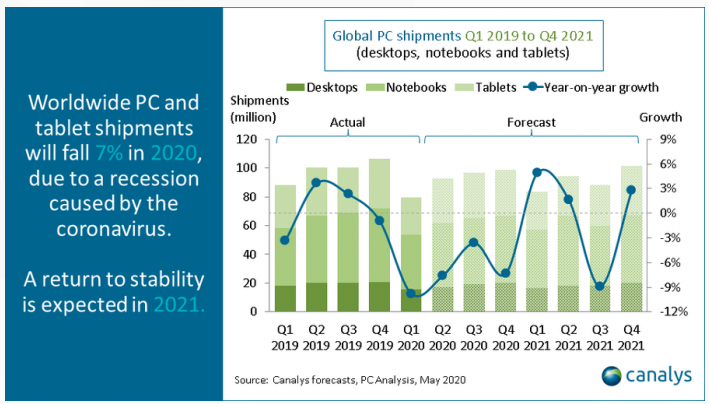

Global PC and tablet shipments will fall 7 percent from 395.6 million units in 2019 to 367.8 million units in 2020. Canalys expects the global PC market will stay flat in 2021 and return to growth of 2 percent in 2022.

There are reasons for vendors, channel partners and component suppliers to be optimistic, as the importance of PCs has come to the fore during the pandemic. “COVID-19 has given the PC industry a boost. Despite the progress that smartphones and tablets have made in recent years, the need for a high-performance mobile computing device has never been more pronounced,” said Rushabh Doshi, Canalys Research Director. Canalys expects the global PC market to return to growth of 2 percent in 2022, with desktop and notebook shipments overcoming prolonged weakness in the tablet space. Regional forecast assumptions China PC and tablet shipments will fall only 3 percent in 2020 and will post growth of 4 percent in 2021 in China. The government’s plan to invest around US$1.4 trillion over six years in the technology sector will provide ample opportunities for the PC ecosystem. Asia Pacific PC market in Asia Pacific will fall 1 percent in 2020, and market recovery will start in 2021. While countries such as South Korea are already well on their way to recovery, the majority of South Asian and Southeast Asian countries are only now experiencing an easing of lockdowns. North America PC and tablet shipments in North America will drop 6 percent in 2020. The United States, as the world’s largest PC market, was affected by supply shortages in Q1 2020. There will be a surge in demand in Q2, driven by large enterprises looking to enable their employees to work from home, as well as a demand boost for Chromebooks from the education sector. Canalys expects that consumers will move away from discretionary spending on non-essential devices, such as Apple tablets, at the end of the year. Europe, the Middle East and Africa PC and tablet shipments to EMEA are set to fall 10 percent in 2020 before posting growth of 1 percent in 2021. Latin America PC shipments in Europe, the Middle East and Africa will dip 16 percent in Q2 2020, with declines of 6 percent and 9 percent in Q3 and Q4. Latin America will return to growth relatively late, in Q2 2021.

|