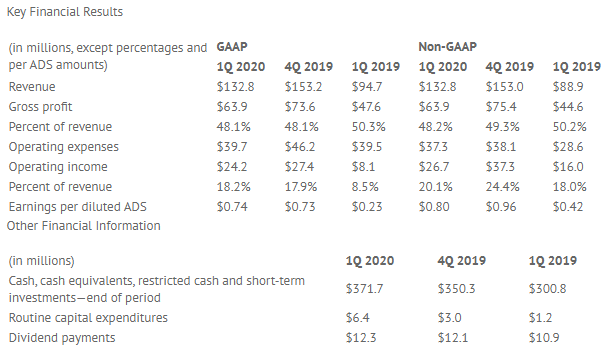

Silicon Motion Technology Corporation today announced its financial results for the quarter ended March 31, 2020. For the first quarter, net sales (GAAP) declined sequentially to $132.8 million from $153.2 million in fourth quarter 2019. Net income (GAAP) increased to $25.9 million or $0.74 per diluted ADS (GAAP) from net income (GAAP) of $25.4 million or $0.73 per diluted ADS (GAAP) in fourth quarter 2019. For the first quarter, net income (non-GAAP) declined to $28.4 million or $0.80 per diluted ADS (non-GAAP) from a net income (non-GAAP) of $33.8 million or $0.96 per diluted ADS (non-GAAP) in fourth quarter 2019. First Quarter 2020 Review “Our first quarter sales were affected by the coronavirus outbreak in China,” said Wallace Kou, President and CEO of Silicon Motion. “The lockdown in China impacted industry supply chains and consumer demand, and China’s GDP declined sharply. Sales to OEM markets during the quarter were largely uninterrupted while sales to our channel markets were more fluid and dynamic. Although sales of both our SSD controllers and eMMC plus UFS controllers declined during the quarter, all three of our key products grew strongly compared to last year.”

Business Outlook “We continue to expect sequential sales growth in the second quarter and remain optimistic about the rest of the year,” said Wallace Kou, President and CEO of Silicon Motion. “While we believe we will continue to benefit from PC sales driven by work-from-home and online learning, China’s gradual post-lockdown economic recovery and the multi-year trends relating to both smartphone embedded storage transitioning from eMMC to UFS and PCs and other client devices transitioning from HDDs to SSDs, we are not providing full-year guidance at this time due to limited visibility in the second half of this year.”

|