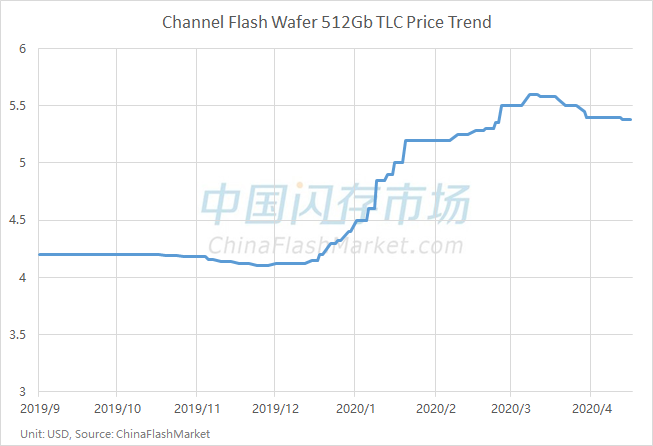

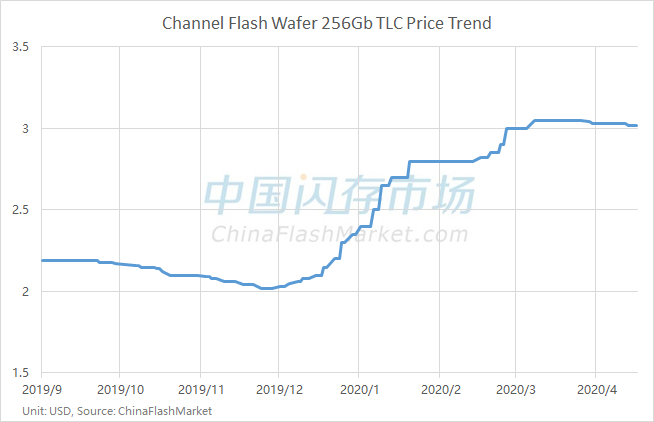

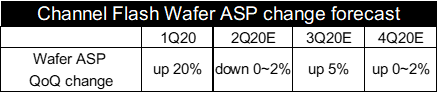

As NAND Flash prices was on a downward trend through a whole year,all of the Flash vendors experienced that earnings fell sharply year-on-year in 2019. Quarter-on-quarter, however, We can see that higher server and mobile demand helped increase Flash bit shipments since 3Q19. Flash vendors focused on addressing increasing demand led by data centers and look forward to next year of rebound strong growth. However COVID-19 changed the situation. In 1Q20, mobile shipments declined sharply as lock-down in China. Although transportation and production in some degree influenced by lock-down, overseas demand remained strong. PCs and servers demand encouraged SSD sales grew great that offset the sluggish demand for memory products of mobiles. As a whole, channel wafer price grew QoQ +20% in 1Q20.

Source: ChinaFlashMarket,Data update until 04/17

Source: ChinaFlashMarket,Data update until 04/17 But when covid-19 soon spread over the world in later March, situation became severe. Overseas demand rapid declined and order reduction or delay happened. Fortunately, on-line study and work from home accelerated PCs and servers demand. We think wafer price will go down QoQ 0~2% in 2Q20. As Flash vendors continue moving more capacity into data center market, the supply of wafer may be lack in other consumer market. Besides the wafer price go down in 2Q20 may start to make the vendors loss money, so wafer price in 3Q20 could be up 0~5% compared to the second quarter. We expected things will be better in 4Q20, wafer price could be up slightly.

Source: ChinaFlashMarket

|