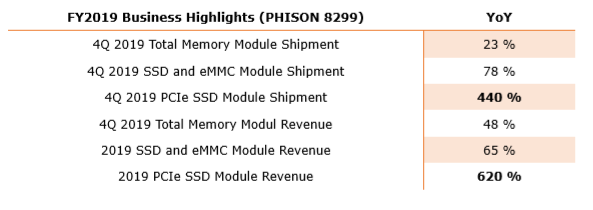

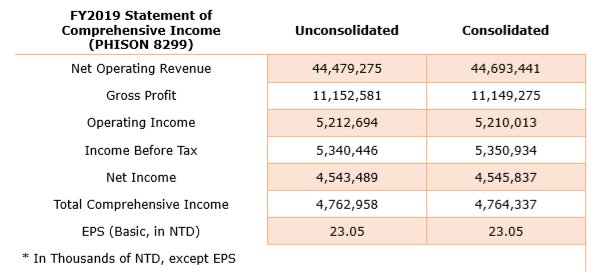

Phison’s 2019 revenue totaled NT$44.693bn, up 10% YoY. Revenue for 4Q 2019 totaled NT$13.173bn, up 30% YoY. Both annual and 4Q revenues of 2019 hit history record high, and 2019 annual EPS NT$23.05 also reaches history 3rd high even facing highlycompetitive NAND industry and most peers suffering from revenue and profit drop in 2019, proving PHISON’s twin-growth-engines model (NAND controller and NAND storage solutions) can effectively drive company’s development against the downside tides. Breaking down the shipment details, total memory module shipment of 4Q 2019 grows over 23% YoY, SSD and eMMC module shipment rises nearly 78% YoY, and PCIe SSD module shipment increases nearly 440% YoY. Furthermore, both annual and 4Q controller IC shipment of 2019 hits history record high. Analyzing the revenue categories, total memory module revenue of 4Q 2019 grows nearly 48% YoY, accumulated SSD and eMMC module revenue of 2019 increases 65% YoY, and annual PCIe SSD module revenue even hits 620% YoY, demonstrating PHISON is growing in both revenue and market share healthily, and high-end PCIe SSD adoption keeps raising as projected.

K.S. Pua, CEO and Chairman of PHISON, said that the operating expenses of Y2019 is 34% higher than Y2018. This is because 5G technology is expected to drive growth of NAND-storage-related applications such as networking infrastructure, AIoT, cloud services, and autonomous vehicle, etc., according to various market intelligence firms, and thus we continuously invest advanced process of NAND controllers. Moreover, PHISON’s strategic development of high-end NAND storage applications such as server, industrial, embedded, and automotive markets also requires massive experienced engineers and related equipment. In comparison with last quarter, the non-operating income of 4Q 2019 from KSI (Kingston Solutions Inc.) has returned from loss to profit. Furthermore, if putting aside the exchange losses due to dynamically international situation in 2019, PHISON’s annual EPS could be increased roughly by NT$0.7. All these earnings result indicates that PHISON outperforms peers despite the facts that Y2019 is a harsh year for most industry companies. To prospect Y2020, PHISON will keep working steadily and making solid progress, and continuously develop high-end NAND storage markets strategically.

|