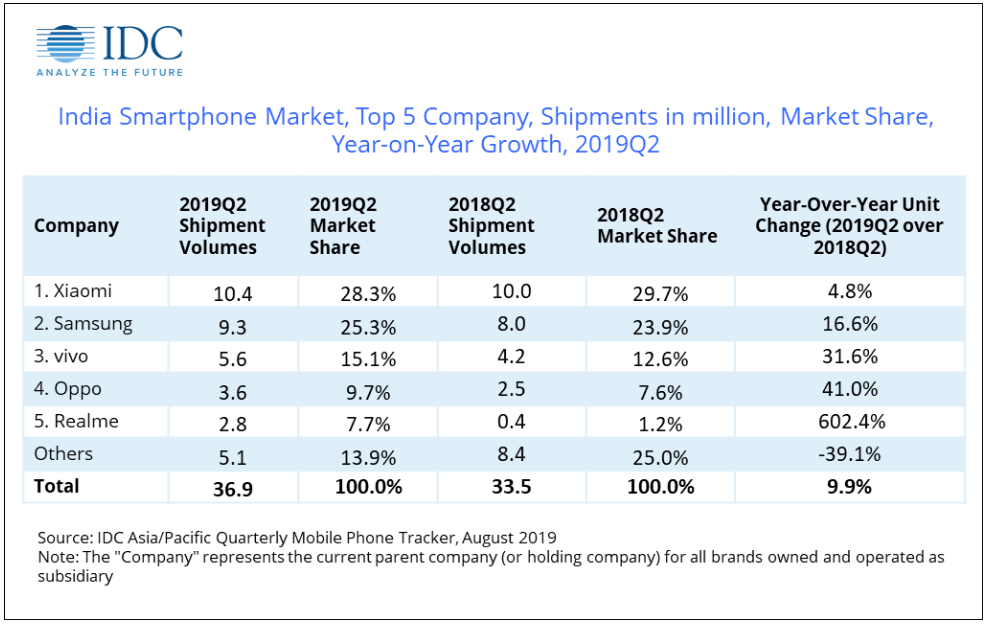

India smartphone market saw highest ever second quarter shipment of 36.9 million in 2Q19, with a 9.9% year-on-year (YoY) and 14.8% quarter-on-quarter (QoQ) growth. A total of 69.3 million mobile phones were shipped to India in 2Q19, which was up 7.6% over the previous quarter.

“Despite the efforts towards multi-channel retailing by almost all vendors, the online channel continued its growth momentum fueled by multiple new launches, attractive offers and affordability schemes like EMIs/cashbacks. This resulted in YoY growth of 12.4% for the online channel with an overall share of 36.8% in 2Q19,” says Upasana Joshi, Associate Research Manager, Client Devices, IDC India. Offline channel registered an 8.5% YoY growth driven by the new launches in Samsung Galaxy A series, marketing activities by vivo during IPL (Indian cricket league) and Xiaomi’s growing multichannel distribution. The overall market ASP stood at US$159 in 2Q19 with 78% of the market below US$200 price segment. However, the fastest growing segment was US$200-300 with 105.2% YoY growth. This was mainly due to the demand from customers looking to upgrade, additionally fueled by China-based brands which are bringing innovations and flagship like design language at mid-price segments. Joshi further adds, “US$400-$600 was the second-fastest-growing segment with 16.3% YoY growth in 2Q19. OnePlus led this segment with a 63.6% share at the back of newly launched OnePlus 7 series. In the premium (US$500+) segment, Apple bettered Samsung for the leadership position with an overall share of 41.2% in 2Q19 as the iPhone XR demand saw an uplift after the price drop and aided by heavy promotional activities. The feature phone market continued its decline with 32.4 million-unit shipments, registering a drop of 26.3% YoY in 2Q19. This was due to lower shipments of 4G-enabled feature phones with 40.3% YoY decline in 2Q19. The 2G feature phone segment also declined as challenges remain for Indian brands along with small players facing heat owing to duty hikes on imports.

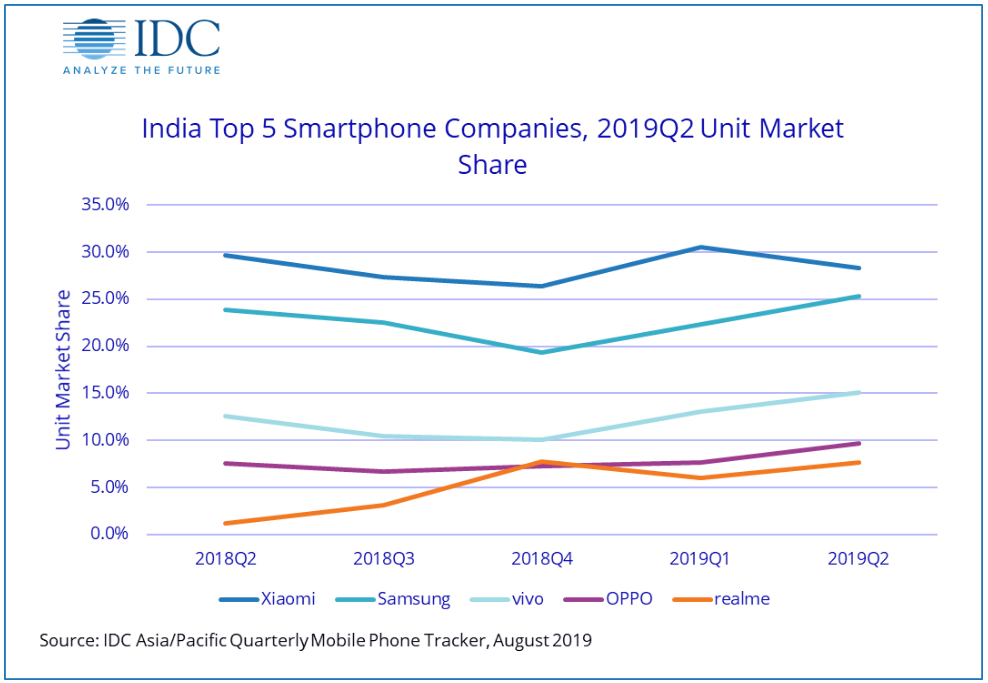

Top 5 Smartphone Vendor Highlights Xiaomi saw its shipment volume grow by 4.8% YoY in 2Q19 with Redmi 6A and Redmi Note 7 Pro as the highest shipped models in the overall market. Xiaomi also maintained its dominance in the online channel with a market share of 46.5%, along with growing footprint in the offline channel which accounted for 39.5% of Xiaomi shipments in 2Q19 Samsung registered a strong 16.6% YoY growth in 2Q19 fueled by newly launched Galaxy A series across low and mid-price segments. Galaxy A10 and A2 Core were amongst the top 5 models overall for the market. The vendor was also offering attractive channel schemes to clear the stocks of Galaxy J series. Galaxy M series (exclusive online till the end of 2Q19) saw price reductions which helped retain the 13.5% market share in the online channel in 2Q19 for Samsung. vivo saw a strong YoY growth of 31.6% in 2Q19. Its affordable model Y91 featured in the top 5 model lists nationally. vivo also launched its first exclusive online model “Z1 Pro” priced aggressively in US$200-300 segment. OPPO had a strong quarter with YoY growth of 41.0%, because of affordable A series - A3s and newly launched A1K and A5s. Online channel accounted for 19.1% for the vendor-driven by online exclusive model “K1”. realme saw multifold growth YoY in 2Q19, driven by newly launched model C2 and 3/3Pro series. The vendor was second in the online channel with 16.5% market share in 2Q19, along with ongoing efforts for expansion in the offline channel which accounted for 21.0% of its shipments in 2Q19. |