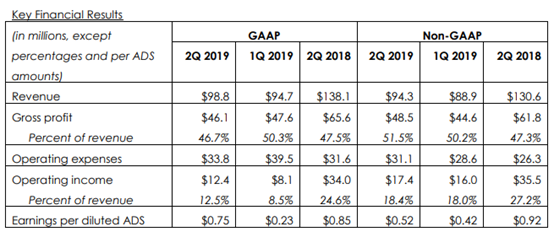

Silicon Motion Technology Corporation announced its financial results for the quarter ended June 30, 2019. For the second quarter, net sales (GAAP) increased to $98.8 million from $94.7 million in the first quarter 2019. Net income (GAAP) increased to $26.5 million or $0.75 per diluted ADS (GAAP) from $8.3 million or $0.23 per diluted ADS (GAAP) in the first quarter 2019. For the second quarter, net sales (non-GAAP) increased to $94.3 million from $88.9 million in the first quarter 2019. Net income (non-GAAP) increased to $18.6 million or $0.52 per diluted ADS (non-GAAP) from $15.0 million or $0.42 per diluted ADS (non-GAAP) in the first quarter 2019.

Business Highlights l SSD Controller sales increased about 15% Q/Q l eMMC+UFS controller sales increased about 20% Q/Q l SSD Solutions sales decreased about 40% Q/Q l Introduced SM3282, industry’s first single chip flash controller for cost effective USB portable SSDs l Completed sale of FCI to Dialog Semiconductor Second Quarter 2019 Review SMI CEO said, Our controller sales continued to strengthen. Sales of both our SSD and eMMC+UFS controllers grew, with SSD controllers to our flash partners growing almost 30% sequentially, while to module makers was weaker than expected. Sales of our eMMC+UFS controllers were stronger than expected, while sales of SSD solutions were worse. Our gross margins, however, were better than expected due to more favorable mix of higher margin controllers. During the second quarter, we had $2.9 million of capital expenditures for the routine purchase of software, design tools and other items. Business Outlook We expect our revenues to continue growing quarter-after-quarter through the balance of this year. We believe that full-year SSD controller shipments will grow strongly and in-line with market expectations, though revenue will likely be less than shipment growth because of less favorable product mix. We believe our client SSD controller market share has continued to increase and that we are well positioned for continued SSD controller growth next year. eMMC+UFS controller sales should continue growing sequentially through the second half of this year, though full-year sales will likely decline meaningfully. Our Shannon open-channel SSDs are now in commercial deployment at our two B-A-T customers, important milestones, but full-year sales will be down sharply compared to last year. Next year, we are expecting SSD solutions to rebound.

|