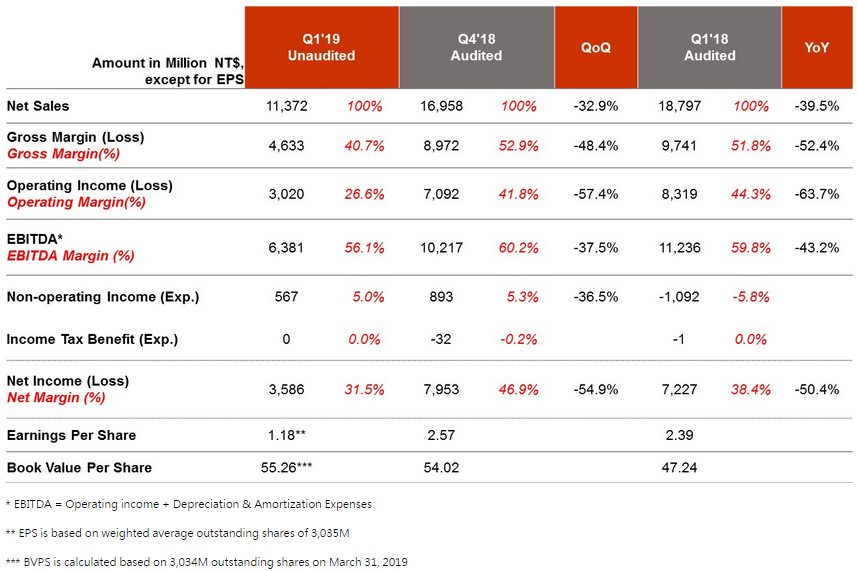

Nanya Technology Corporation, (TWSE: 2408), today announced its results of operations for the first quarter, ended March 31st, 2019. Nanya’s quarterly sales revenue was NT$ 11,372 million, a 32.9 percent decrease compared to the fourth quarter, 2018. In the first quarter of 2019, average selling prices (ASP) decreased by low twentys percent and bit shipment decreased by low teens percent quarter over quarter. Gross profit of the quarter was NT$ 4,633 million, gross margin was 40.7 percent, a 12.2 percentage points decrease compared with the previous quarter. Operating Income of the quarter was NT$ 3,020 million, operating margin was 26.6 percent. Operating margin decreased by 15.2 percentage points compared with the last quarter. Non-operating income of the quarter was NT$ 567 million primarily from interest incomes of NT$394 million and the rest from foreign exchange gains. The Company had net profit of NT$ 3,586 million, with net margin of 31.5 percent, a 15.4 percentage points decrease compared with the previous quarter. Earnings per share (EPS) was NT$ 1.18 in the first quarter (the earnings per share calculations are based on weighted average outstanding shares of 3,035 million). Book value per share was NT$ 55.26 at the first quarter end. All numbers are unaudited. Nanya’s Board of Directors has approved cash dividends of NT$ 21,700 million. Estimated cash dividend per share will be between NT$ 7.09 and NT$ 7.15. The dividend distribution is subjected to the final approval by the AGM on May 30th. To better position for future product portfolio, the company has allocated 5~10% more capacity to technology and product development activities to optimize product portfolio and product value enhancement. In response to the current market conditions, capital expenditures (Capex) plan in 2019 is expected to be reduced from NT$ 10.6 billion to approximately NT$7.0 billion. Q1 2019 Consolidated Income Statement

|