ON Semiconductor has agreed to buy Wi-Fi chip vendor Quantenna Communications for just over $1 billion in cash.

The acquisition is expected to bolster ON Semi's connectivity chip portfolio, which today consists mainly of wireless RF transceivers supporting protocols such as Bluetooth, Sigfox, ZigBee, Threat, 6LoWPAN and others.

San Jose-based Quantenna was founded in 2006 by a team that included Andrea Goldsmith, Behrooz Rezvani and Farrokh Farrokhi. The company's Wi-Fi chipsets include both dynamic digital beamforming and wireless channel monitoring and optimization. Quantenna first appeared on the EE Times Silicon 60 list of emerging startups in 2009.

Keith Jackson, ON Semi's president and CEO, said Quantenna's Wi-Fi technologies and software expertise — combined with ON Semi's efficient power management — would bolster the company's ability to provide low-power connectivity technology for industrial and automotive applications.

"The acquisition of Quantenna is another step towards strengthening our presence in industrial and automotive markets," Jackson said.

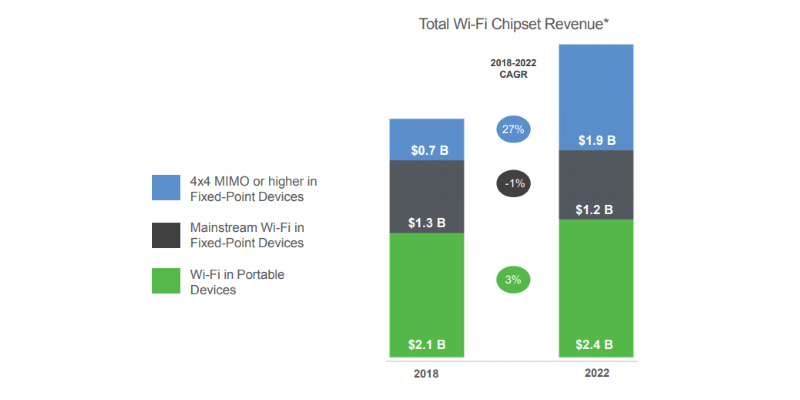

ON Semi says Quantenna's chips serve the attractive part of the total Wi-Fi chipset market. (Chart showing projected growth of total available market, courtesy of ON Semi).

Under the terms of a definitive agreement between the two companies, ON Semi will pay $24.50 in cash for each share of Quantenna, making the deal worth about $1.07 billion in total. The deal has an enterprise value of about $936 million when accounting for about $136 million in cash on Quantenna's books at the end of 2018, ON Semi said.

The deal remains subject to customary closing conditions, including regulatory approvals and approval by Quantenna's shareholders. The deal has already been approved by both companies' boards of directors and is expected to close in the second half of 2019.

The bulk of Quantenna's employees are expected to join ON Semi as the result of the acquisition. ON Semi said it has identified approximately $26 million in cost synergies between the two firms. |