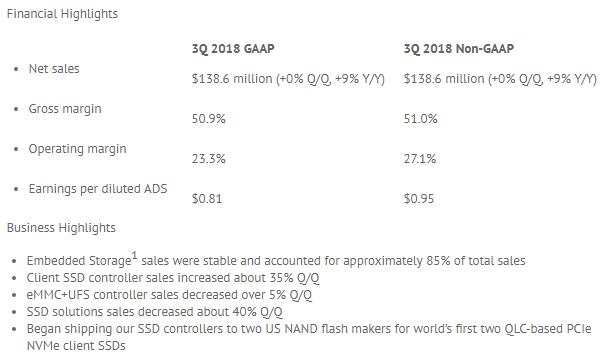

Silicon Motion Technology Corporation (“Silicon Motion” or the “Company”) today announced its financial results for the quarter ended September 30, 2018. For the third quarter, net sales increased sequentially to $138.6 million from $138.1 million in the second quarter 2018. Net income (GAAP) decreased to $29.2 million or $0.81 per diluted ADS (GAAP) from a net income (GAAP) of $30.7 million or $0.85 per diluted ADS (GAAP) in the second quarter 2018.

For the third quarter, net income (non-GAAP) increased to $34.5 million or $0.95 per diluted ADS (non-GAAP) from a net income (non-GAAP) of $33.2 million or $0.92 per diluted ADS (non-GAAP) in the second quarter 2018.

Third Quarter 2018 Review

“Our third quarter client SSD controller sales grew strongly as declining NAND pricing reduced the cost of SSD, which accelerated SSD adoption in PCs,” said Wallace Kou, President and CEO of Silicon Motion. “In the quarter, two US NAND flash makers began shipping the world’s first client SSDs with their 4-bits per cell QLC 3D NAND using our controllers. We believe these lower cost, high performance PCIe NVMe SSDs will help drive further displacement of HDDs in PCs and other client devices. Separately and as expected, our SSD solutions declined in the third quarter due to timing of a technology transition at our major hyperscale customer. Our eMMC+UFS controller sales were soft primarily due to smartphone market weakness.”

Business Outlook

“Our client SSD controller sales momentum continues to improve as the cost of NAND has been falling and SSDs are becoming increasingly affordable,” said Wallace Kou, President and CEO of Silicon Motion. “Full-year sales of our client SSD controllers are now tracking towards a 35% growth rate. We believe this positive trend will extend further next year. However, both our SSD solutions and eMMC+UFS controller sales are tracking below prior expectation due to product transition timing and weaker end-market demand. Nevertheless, in spite of weaker than expected sales for the full year, we anticipate that our full-year margins will be better than expected because of stronger SSD controller sales and believe our earnings growth remains strong.” |