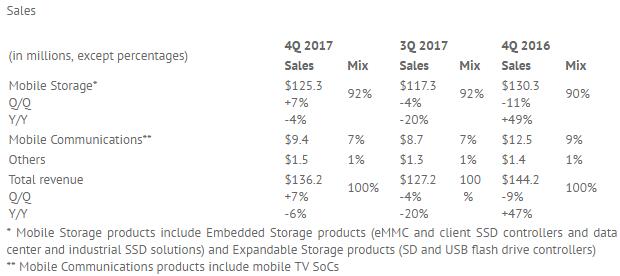

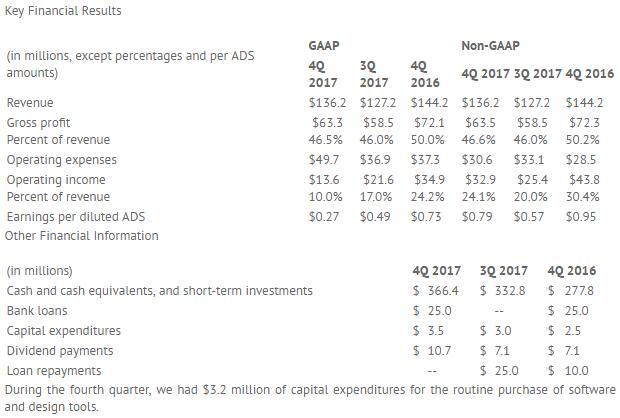

Silicon Motion Technology Corporation (“Silicon Motion” or the “Company”) today announced its financial results for the quarter ended December 31, 2017. For the fourth quarter, net sales increased 7% sequentially to $136.2 million from $127.2 million in the third quarter. Net income (GAAP) decreased to $9.9 million or $0.27 per diluted ADS (GAAP) from a net income (GAAP) of $17.6 million or $0.49 per diluted ADS (GAAP) in the third quarter.

For the fourth quarter, net income (non-GAAP) increased to $28.4 million or $0.79 per diluted ADS (non-GAAP) from a net income (non-GAAP) of $20.3 million or $0.57 per diluted ADS (non-GAAP) in the third quarter.

Embedded Storage comprises primarily eMMC and client SSD controllers and data center and industrial SSD solutions.

Business Highlights

Embedded Storage1 sales increased approximately 10% Q/Q and accounted for about 80% of total sales, similar to the previous quarter

Client SSD controller sales increased over 15% Q/Q

eMMC controller sales remained stable Q/Q

SSD solutions sales increased over 15% Q/Q

Began shipping our SATA3 SSD controller for Micron’s Crucial MX500 SSD and our 2nd generation PCIe NVMe controller for Intel’s 760p SSD

Delivered pre-production samples of our Open-Channel NVMe SSD controller to hyperscale data center customer

Fourth Quarter 2017 Review

“This quarter, NAND flash industry supply continued to improve and prices continued to soften,” said Wallace Kou, President and CEO of Silicon Motion. “Our SSD controller sales to our NAND flash partners rebounded, SSD solutions sales, specifically to our diversified Ferri OEM customers exceeded expectations, and our eMMC controller sales were stable sequentially.”

Our fourth quarter cash flows were as follows:

On August 1, 2017, the Company announced that its Board of Directors had authorized a new program for the Company to repurchase up to $200 million of its ADS over a 12 month period. In the fourth quarter, the Company did not repurchase any of its ADS.

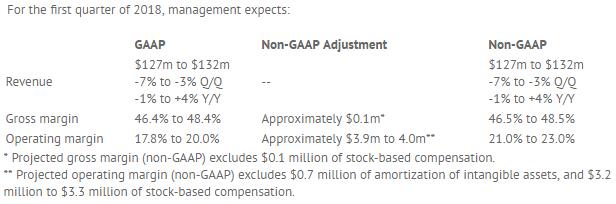

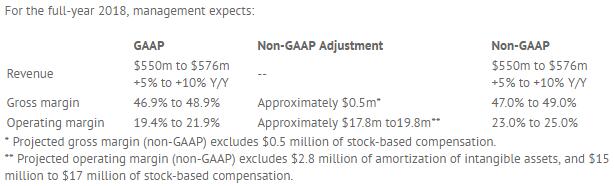

Business Outlook

“This year, we believe that we will benefit from better industry dynamics. As NAND industry supply continues to increase, we expect both NAND cost and prices will fall further,” said Wallace Kou, President and CEO of Silicon Motion. “Our NAND partners are placing more emphasis on their client SSDs because of strong interest by PC and other OEMs in increasing adoption of SSDs, which is highly dependent on how quickly NAND prices fall. We believe NAND prices will fall quickly, but do not have good visibility on this, so our revenue guidance assumes SSD demand based solely on today’s NAND prices. We will revise our guidance when there is better clarity on market trends. In Q1, we believe that growth of SSD and eMMC controller sales should be more than offset by seasonal decline of our SSD solutions.”

|