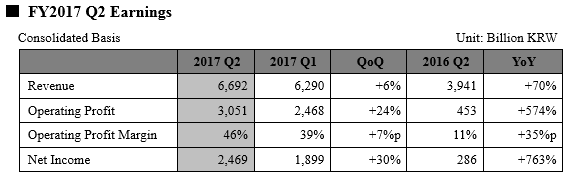

SK Hynix Inc.today announced financial results for its second quarter 2017 ended June 30, 2017. The Company reported its best-ever quarterly revenue, operating profit and net income in two successive quarters.

The consolidated second quarter revenue was 6.69 trillion won while the operating profit amounted to 3.05 trillion won and the net income totaled 2.47 trillion won. During the second quarter, favorable market conditions continued to raise memory semiconductor prices. The Company benefited by dealing well with the market situation, elevating its revenue and operating profit by 6% and 24% each compared to the previous quarter.

Quarter-over-quarter, DRAM bit shipments increased 3% and the average selling price rose 11%. Both grew up, courtesy of strong demand from a server sector.

For NAND Flash, the bit shipments declined 6% but the average selling price rose 8%. The shipment decreased due to sluggish demand growth in smartphones but the ASP could increase thanks to ongoing strong chip prices in every NAND Flash product category.

In the latter half, SK Hynix is to consolidate its position in the memory market with the operation of the product portfolio centered on server and mobile applications, which are expected to persistently lead market demands. The Company will expand the mass production volume of a high-end mobile LPDDR4X and also start to mass produce 1Xnm DRAM in the second half as planned.

Plus, it will begin to manufacture 3D NAND Flash in a full scale on the upper floor of M14 FAB. Moreover, with its cutting-edge 72-Layer 3D NAND, SK Hynix plans to supply mobile solutions and cSSDs at the end of this year then eSSDs in the next year. |