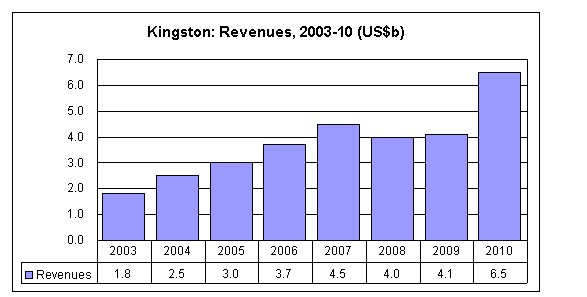

Kingston Technology's revenues hit a record high of US$6.5 billion for 2010, representing a 58.5% on-year growth. However, high sales do not necessarily mean profits are high as well, company co-founder David Sun pointed out in a recent interview with Digitimes.

In early 2009, Kingston bought DRAMs for as low as US$0.50 per unit. Later in the year when the industry began its recovery, the chips were actually sold for US$2-3 each. In 2010 when the business seemed to be booming, the company purchased the chips for US$3 per unit but could only market them at US$3.20. Like books, you cannot judge an industry by its cover, Sun pointed out.

Looking into the remainder of 2011, a supply-demand balance would be a worst-case scenario for suppliers, Sun said. There is also a possibility demand would exceed supply later this year, Sun added.

The following is the interview during which Sun discussed Kingston's business opportunities in the increasingly-popular mobile computing sector, and his outlook for the company.

Q: Would you share your views on the industry climate in the second half of 2011?

A: Despite uncertainties created previously by the impact of Japan's March 11 earthquake on the global supply chain, the memory market for the remainder of this year should return to a balance between demand and supply. However, from a supplier's perspective, the balance situation is considered unfavorable.

But I personally think that there could be slight undersupply of memory chips in the second half of this year, and result in price increases.

A slowdown in the PC market has cast a shadow over the outlook for DRAM memory. However, losses in PC consumption of DRAMs are being offset by rising demand coming from the smartphone and tablet PC sectors. The emergence of cloud computing has also spurred demand significantly for advanced server systems.

Faced with the changing patterns in end-user demand, DRAM makers are allocating more capacity for production of mobile DRAM and server-use products, as well as GDDR memory for game consoles and high-performance computing applications. What we see here is capacity for conventional PC-use DRAM has been squeezed, which is actually helping prices for the commodity type of chip become stable.

In addition, DRAM availability was previously affected when several suppliers experienced yield challenges beyond 50nm. They are likely to encounter the same problem during the transition to 30nm-class process. Accordingly supply would not be over-expanded in the near term.

As for NAND flash, the outlook for the second half of 2011 is brisk. But the optimism does not take in consideration supply constraints and the effect of Japan's earthquake in March. Tablets have created a new market and brightened the sector's outlook, while demand for smartphones is steadily growing. Meanwhile, emerging applications such as eMMC solutions for smartphones and solid-state drives (SSD) are also expected to drive new NAND demand.

Q: How do you see this new wave of demand for mobile computing being driven by the iPad?

A: Mobile computers such as the tablet PC are among the fast-growing device applications that will drive robust consumption of NAND flash chips, and related storage components such as integrated solid-state drives (SSD) and embedded MMC (eMMC) solutions. The market for tablets looks promising for the foreseeable future and I personally don't think consumers' thirst for tablet PCs is just a short-term phenomenon.

Kingston itself is also evaluating the possibility of tablets replacing notebooks. Tablets will eat into some notebook sales for sure.

But growth in DRAM consumption is not going to benefit from the rising demand for tablets. Tablets contain up to 2GB of mobile DRAM, when conventional notebooks are built with generally 3-4GB of DRAM. In addition, for tablets there is no space reserved for DRAM upgrade whereas notebooks usually come with slots to allow users to upgrade.

While the popularity of tablets is rising to partially cannibalize the notebook market, demand for home-use desktop PCs are expected to return, which will help drive up total consumption of DRAMs.

Q: As the DRAM module business becomes mature, how would Kingston respond to stagnant growth in the PC market?

A: In 1990 when sales of memory upgrades were booming, no one found that consumer notebooks would emerge to squeeze the desktop market and simultaneously hurt demand for memory upgrades. Now it's the tablet PC, which willl likely lead to a narrower DRAM module marketplace.

Acknowledging this inevitable situation, Kingston is gearing up for development of new products targeted at fast-growing applications such as smartphones and tablets. But we also do not want to give up the existing DRAM module business.

In addition, there are opportunities related to cloud computing. Growing adoption of cloud computing will boost demand for data center servers. We have enjoyed significant growth in sales generated from server DRAM products.

Kingston's server DRAM business generated sales of US$250 million in 2010, up from only US$80 million in 2009. Sales will continue growing to US$300-350 million this year.

Q: Can you talk about your recent deployment in the eMMC field? How does Kingston differentiate itself from market leader Samsung?

A: In the face of rising smartphone and mobile computing demand, Kingston announced at the end of 2010 its entry into the embedded memory territory dominated by Samsung and other major chip firms.

Kingston's eMMC solutions use controllers provided by Phison Electronics, and are packaged by Powertech Technology (PTI). We consumed about two million NAND chips for use in eMMC devices during the second quarter. The number is expected to reach 2.5-3 million in the third quarter.

Kingston's eMMC focus is not aimed at competing directly with those chip vendors, which mainly do business with brand-name consumer electronics (CE) and handset companies. Kingston is actually targeting non-top-tier players in the CE and handset marketplaces, which we view as a potential growing area.

Besides, Kingston is also eyeing to be a preferred backup supplier of embedded memory when Samsung and other major suppliers experience tight capacity.

Q: Can you talk about Kingston's existing cooperation with NAND device controller suppliers?

A: Kingston has made equity investments in several controller design firms including Phison, Skymedi, Solid State System (3S) and JMicron Technology, which play different roles in our partnerships.

We are partnering with Phison for embedded NAND devices compliant with the eMMC standard, for example. Phison's controllers mainly support NAND chips made by Toshiba and Hynix used for flash memory cards and drives. We'd like to use its superior controller IC technology to develop eMMC-interface NAND devices, the field that requires high technology threshold.

Kingston also holds a stake in JMicron as part of our efforts to expand the SSD product line.

Q: How would you adjust your capacity to sustain future growth?

A: Kingston has production plants in the US, Shanghai and Taiwan. We also outsource part of our production. Taiwan is the top priority if we consider expanding capacity.

Kingston currently maintains a 40% outsourcing ratio.

|