Micron Technology, Inc., today announced results of operations for its third quarter of fiscal 2017, which ended June 1, 2017. Revenues for the third quarter of fiscal 2017 were a record $5.57 billion and were 20 percent higher compared to the second quarter of fiscal 2017 and 92 percent higher compared to the third quarter of fiscal 2016.

"Micron delivered strong operational performance in the third quarter with free cash flow nearly double last quarter, which enabled us to retire $1 billion in debt. Our results reflect solid execution of our cost reduction plans and ongoing favorable industry supply and demand dynamics," said Micron President and CEO Sanjay Mehrotra. "The global trends taking shape today, including machine learning and big data analytics, are exciting and create significant opportunities for Micron. We are focused on positioning the company to realize these opportunities by investing in technology and products while also strengthening our balance sheet."

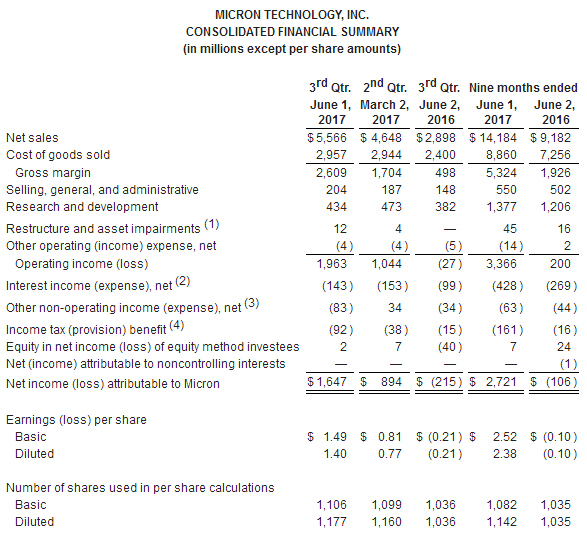

GAAP Income and Per Share Data — On a GAAP basis, gross margin was 46.9 percent and net income attributable to Micron shareholders was $1.65 billion, or $1.40 per diluted share, for the third quarter of fiscal 2017 compared to gross margin of 36.7 percent and net income of $894 million, or $0.77 per diluted share, for the second quarter of fiscal 2017 and gross margin of 17.2 percent and a net loss of ($215) million, or ($0.21) per diluted share, for the third quarter of fiscal 2016.

Non-GAAP Income and Per Share Data — On a non-GAAP basis, gross margin was 48.0 percent and net income attributable to Micron shareholders was $1.90 billion, or $1.62 per diluted share, for the third quarter of fiscal 2017 compared to gross margin of 38.5 percent and net income of $1.03 billion, or $0.90 per diluted share, for the second quarter of fiscal 2017 and gross margin of 18.1 percent and a net loss of ($29) million, or ($0.03) per diluted share, for the third quarter of fiscal 2016. For a reconciliation of GAAP to non-GAAP results, see the accompanying financial tables and footnotes.

The fiscal third quarter revenue increase of 20 percent compared to the previous quarter was due primarily to a 14 percent increase in DRAM average selling prices and a 17 percent increase in trade NAND sales volumes. The company's overall consolidated gross margin for the third quarter of fiscal 2017 was approximately 10 percentage points higher compared to the previous quarter primarily due to increases in DRAM average selling prices and manufacturing cost reductions for both NAND and DRAM.

Investments in capital expenditures, net of amounts funded by partners, were $1.27 billion for the third quarter of fiscal 2017. The company ended the third quarter of fiscal 2017 with cash, marketable investments, and restricted cash of $4.90 billion.

|