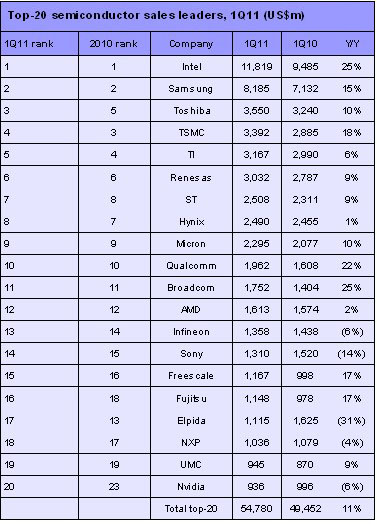

has issued its revealed ranking of the top semiconductor suppliers in the first quarter of 2011. Intel remained firmly in control of the number one spot in the ranking, extending its lead over second-ranked Samsung Electronics by registering a 44% higher sales level than Samsung as compared to a 24% margin for all of 2010.

Nvidia's sales decreased by 6% on year in the first quarter of 2011, but it replaced Panasonic whose sales declined by 9%. Excluding pure-play foundry companies, Marvell and ON Semiconductor would have been included in the top 20 ranking. With ON's purchase of Sanyo Semiconductor in the first quarter of 2011, ON's semiconductor sales jumped by 58% to US$$871 from US$550 million in the same quarter a year before.

In total, the top 20 semiconductor suppliers showed a sales increase of 11% in the first quarter of 2011 as compared to a year ago. This growth rate is one point greater than IC Insights' full-year 2011 worldwide semiconductor market forecast of 10%.

also learned that there was a wide range of on-year growth rates among the top 20 suppliers in the first quarter of 2011. Unlike 22010, the memory companies did not secure the top growth rate positions. In fact, the top six on-year growth rate increases were logged by non-memory suppliers.

Of the big five memory suppliers in the top 20 ranking, all but Elpida Memory registered on-year growth in the first quarter of 2011. With strong results from flash memory products helping to offset weakness in their DRAM segments, Samsung, Micron Technology and Toshiba were each able to display double-digit increases on year in the first quarter. In contrast, DRAM-dependent Elpida registered the worst performance with a 31% drop in revenues .

Among the top 20 suppliers, only seven companies outperformed the total worldwide semiconductor industry growth rate of 10% in the first quarter of 2011 . Of the top seven performers, there was only one memory producer, Samsung. The remaining top performing companies included MPU supplier Intel, pure-play foundry Taiwan Semiconductor Manufacturing Company (TSMC), and logic-intensive suppliers Broadcom, Qualcomm, Fujitsu and Freescale.

|